[EXAMPLE]

Official Records, Smarter Deals: A Due Diligence Game-Changer

Why verified company data is the missing piece in cross-border M&A strategy

In the high-stakes world of international mergers and acquisitions (M&A), due diligence isn’t just a box to tick—it’s a lifeline. It’s akin to playing a strategic chess match with half the pieces hidden – a risk that global investors face when they enter deals without access to verified, official company data; the need for caution and thoroughness in every step of the M&A process is underscored by the potential pitfalls of not using verified data.

Recent regulatory setbacks—such as the collapse of major tech-sector mergers due to antitrust crackdowns in the EU and the U.S. – highlight the urgency of robust due diligence. These oversights in vetting ownership structures or financial liabilities have not only cost buyers millions but also triggered regulatory fallout. The economic implications and the urgency of robust due diligence in the M&A process are underscored by this tendency; at this particular point, verified registry data becomes not just helpful but essential. G-BRIS, a reliable source, delivers original company documents directly from government registries in over 17 jurisdictions. This service helps M&A professionals identify hidden risks before signing the dotted line, providing reassurance and confidence in their decision-making.

Why Official Records Matter in M&A Due Diligence

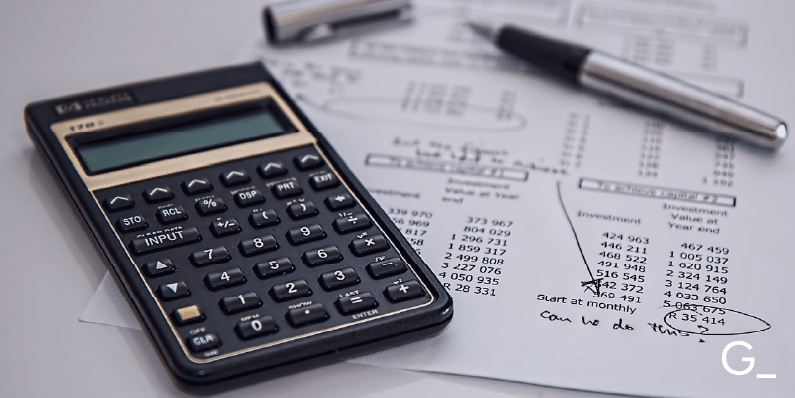

Smart M&A decisions require clear answers to critical questions:

- Is the target company legally sound? (e.g., incorporation records, bylaws)

- Are its financials trustworthy? (e.g., audited annual reports)

- Who owns and controls it? (e.g., shareholder and UBO disclosures)

- What’s its regulatory history? (e.g., registry filings, director changes)

Working with unofficial or outdated data can lead to inflated valuations, unforeseen legal liabilities, or even deal collapse. Equipped with primary-source documents, G-BRIS provides a reliable and secure solution, ensuring factual integrity and peace of mind.

Key Documents G-BRIS Provides for M&A Due Diligence:

- Annual financial statements and incorporation records

- Registry excerpts and filings

- Articles of association

- Director and shareholder lists

- Certificates of good standing

With no account creation, fast delivery, and direct registry sourcing, G-BRIS simplifies the traditionally time-consuming process of cross-border entity verification, relieving you from the burden of these tasks.

The Competitive Edge of Verified Data

Access to verified documents allows dealmakers to:

- Identify red flags early in the M&A pipeline

- Ensure compliance with local and international regulatory frameworks

- Conduct defensible, audit-ready investigations

- Justify valuations with confidence grounded in real data

Conclusion: A Smarter, Safer Way to Deal Globally

In today’s hyper-regulated, risk-averse environment, access to verified company records is no longer optional—it’s a competitive necessity; investors, legal teams, and M&A advisors must be able to validate the legal standing, financial health, and ownership structures of target companies across borders.

G-BRIS enables this with ease, offering a centralized and reliable platform to gather certified records directly from the source; when deal-making speed and precision matter most, verified data can mean the difference between a smooth acquisition and a costly misstep.