[EXAMPLE]

United Kingdom company types and available documents

Companies House is the official register for businesses in the UK, overseeing company incorporation and record-keeping. It ensures legal compliance by maintaining up-to-date company information, including financial statements and director details. This helps promote transparency and accountability in the UK’s corporate sector.

G-BRIS offers validated documents from the local business registry for the following entity types:

Private limited Company

Limited liability partnership

Public limited Company

With G-BRIS, you can access the following validated company documents:

Incorporation documents

The document contains:

- Date of establishment

- Company details

- Directors/officers

- Statement of Capital

- Shareholder information

- Memorandum of Association

- Articles of Association

Extract of persons holding significant control

The document contains:

- Persons with significant control

- Significant control person details

- Correspondence address

- Date appointed

- Date of birth

- Nationality

- Country of residence

- Nature of control

- Ownership of shares

- Ownership of voting rights

Extract of current officers

The document contains:

- Officer position

- Nationality

- Date appointed

- Date of birth

- Correspondence address

- Country of residence

Full official extract from the business registry

The document contains:

- Company overview

- Company address

- Incorporation date

- Company status

- Key filing dates

- Nature of business

- People

- Officers

- Resignations

- Persons with significant control

- Recent filing history

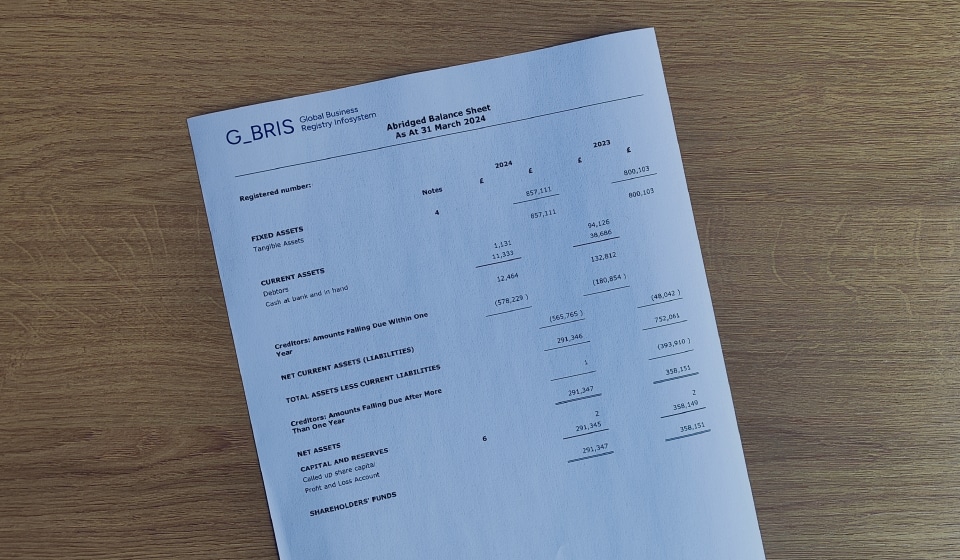

Annual report with financial statements

Most companies are required to submit their annual report within six months after the end of the financial year. Annual reports for the 2024 financial year will be available by mid-2025.

In the UK, the contents of an annual report vary based on company size:

Small Companies: Simplified financial statements, optional audit, and basic directors’ report. No strategic report required.

Medium-Sized Companies: More detailed financial statements, mandatory audit, directors’ and strategic reports required.

Large Companies: Comprehensive financial statements, mandatory audit, detailed directors’ and strategic reports, corporate governance disclosures required.

Public Limited Companies (PLCs): Follow large company requirements with additional disclosures on shareholder rights and executive pay.

Micro-Entities: Simplified financial statements, audit exemption, no strategic report required.