[EXAMPLE]

Belgium company types and available documents

In Belgium, the Kruispuntbank van Ondernemingen (KBO) acts as the central authority for managing corporate registration and compliance. It maintains a comprehensive database of businesses, ensures transparency, and provides public access to essential company information. By streamlining processes and supporting legal compliance, the KBO fosters trust and efficiency in the business ecosystem.

G-BRIS offers validated documents from the local business registry for the following entity types:

Naamloze Vennootschap (NV)/Société Anonyme (SA) – Public Limited Company

Besloten Vennootschap (BV)/Société à Responsabilité Limitée (SRL) – Private Limited Company

Coöperatieve Vennootschap (CV)/Société Coopérative (SC) – Cooperative

Commanditaire Vennootschap (CV)/Société en Commandite Simple (SCS) – Limited Partnership

Vennootschap onder firma (VOF)/Société en Nom Collectif (SNC) – General Partnership

With G-BRIS, you can access the following validated company documents:

Full official extract from the business registry

The document contains:

- Company name

- Company number

- Company status

- Date of incorporation

- Company address

- Entity type and legal form

- Directors and representatives

- Capital information

- Financial year end date

- Links between other entities

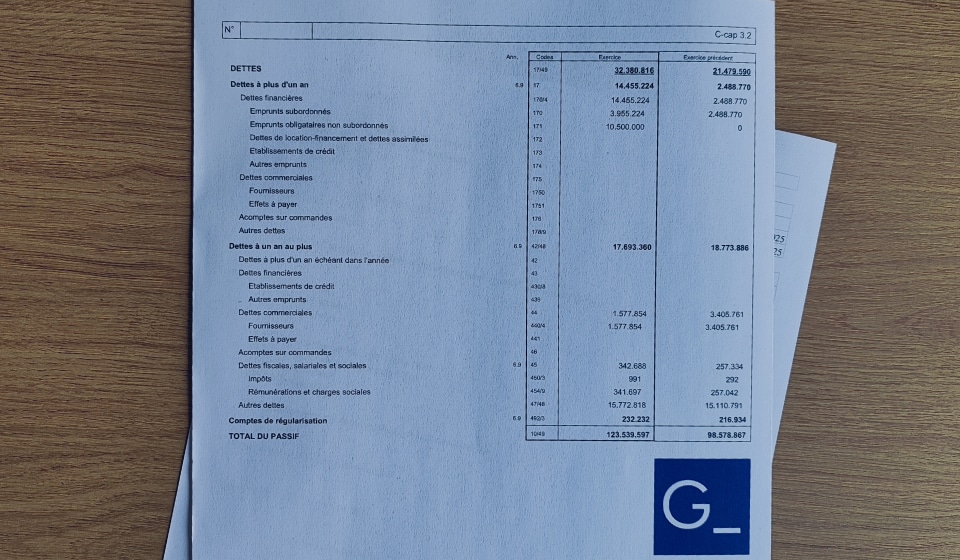

Annual report with financial statements

Depending on the region, financial statements can be filed in different languages (Dutch, French or German).

Reports for all company types contain:

- Director’s Report

- Financial Statements (Balance sheet, profit and loss, and cash flow statement)

- Filing with the National Bank of Belgium

Public Limited Company (SA/NV):

In addition to the above requirements, the annual report must also include:

- Corporate Governance Report

- Sustainability/CSR Report (if size thresholds are met)

- Risk Management Report

- Shareholder Information

Cooperatives (CV):

In addition to the above requirements, the annual report must also include:

- Auditor’s Report (if size thresholds are met)

- Director’s Report (including member activities and dividends)

- Corporate Governance Report (basic practices)

Small Companies (Micro and Small Enterprises)

In addition to the above requirements, the annual report must also include:

- Simplified Director’s Report

- Simplified Financial Statements (no cash flow statement for micro-companies)

- Auditor’s Report (not required for micro-companies)

Search for companies registered in Belgium